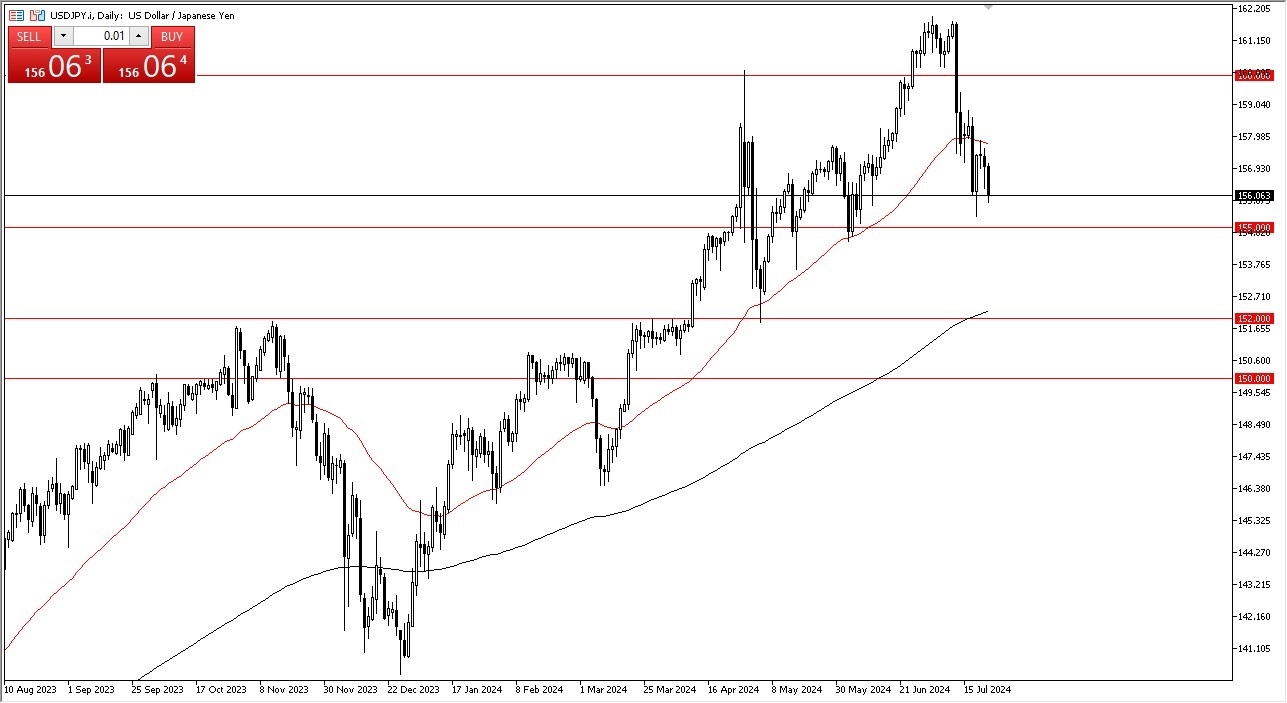

- We have seen a significant amount of selling pressure in the US dollar against the Japanese yen.

- At this point in time, we are watching the ¥155 level very closely as it is a large, round, psychologically significant figure, but it is also an area where we have seen a lot of support previously.

- In other words, I think that a lot of people will be interested in this pair near this region. With this, I suspect we are trying to set up some kind of trade in the near future.

With that being said, I do think at this point in time, buyers will continue to jump in and try to take advantage of cheap US dollars. A breakdown below the ¥155 level could open up further selling, perhaps pushing this pair down to the ¥152 level, an area that has been important from both a support and a resistance barrier multiple times in the past. It also features the 200 day EMA. So that, of course, is an indicator that a lot of people will pay attention to them. Ultimately, I think this is still a market looking to buy dips, and due to the interest rate differential between the United States and Japan, which shows no real hint of shrinking significantly, as the two economies are in totally different places.

You Get Paid Over the Long Run

In other words, you will continue to get paid to hang on to this USD/JPY pair at this point. If we were to turn around and break above the 50 day EMA, which is just above the last couple of daily candlesticks, then we could open up the possibility of a move to the ¥160 level.

It has been a significant pullback over the last couple of weeks, but the reality is that we are still very much in an uptrend, and therefore, I think we’ve got a situation where buyers continue to jump in and take advantage of the cheap greenback. Every time we see a little selling.

Ready to start trading USD/JPY analysis? Get our list for top brokers in Japan here.