Social and copy trading focused Retail FX and CFDs broker The NAGA Group AG (ETR:N4G) has issued its first half 2024 report, providing some more insight into the operations and status of the company following its acquisition by CAPEX.com operator Key Way Group.

We had already reported, in early July, some of NAGA Group’s 2024 H1 summary figures which included a nice rise in Revenues from last year, and a return to EBITDA profitability thanks in part to a series of cost cutting efforts.

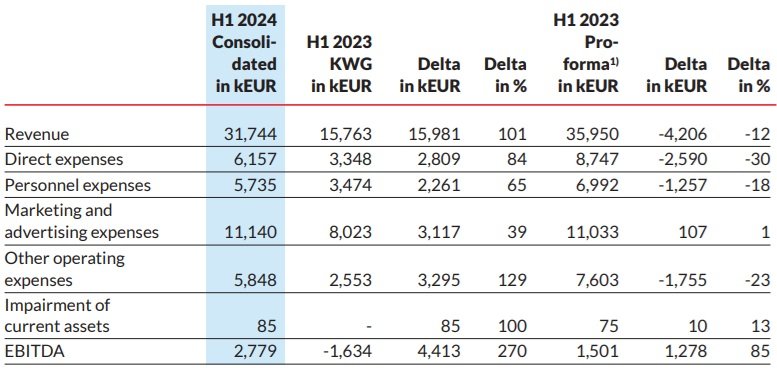

Although the merger with Key Way Group was completed in August, NAGA’s first half 2024 report is presented on a consolidated basis (i.e. with Key Way Group). And for an apples-to-apples comparison the company included some pro forma comparative stats between 2024 and 2023, as if the two companies had been combined back then.

NAGA Group Revenues

As per the table above, NAGA Group did €31.7 million in Revenues in the first half of 2024, which was down by 12% from €35.9 million (pro forma) last year. As expected, this shortfall was due to the optimization of former nonprofitable business units as part of the new group’s strategy post-merger. The new group‘s commitment to profitability and operational efficiency is expected to be a catalyst in driving future revenue and margin growth.

NAGA Group Expenses

A large 30% cut in Direct expenses, with 18% and 23% reductions in Personnel and Operating expenses respectively, led to an 85% increase in EBITDA at NAGA Group in the first half of 2024, to €2.8 million. The company said that these reductions in costs underscore the Group‘s focus in the first half of 2024 on optimizing staff structure and renegotiating contracts to improve operational efficiency. As a result, these efforts contributed significantly to the EBITDA margin improvement, leveraging the immediate post-merger benefits and operational synergies.

Regarding marketing expenses, which were fairly held fairly steady in 1H 2024, NAGA said that looking ahead it anticipates marketing and advertising expenses to grow as the Group increasingly leverages online marketing channels, influencer campaigns, and enhanced branding efforts to attract, engage, and improve client lifetime value in order to scale revenue. The company also expects a corresponding optimization in user acquisition costs through a multi vertical approach, marketing automation processes, and organic growth initiatives, further supporting margin expansion in the long term.

NAGA Group consolidated client trading volumes came in at €121 billion for the first half of 2024, or about USD $22 billion monthly.

Looking forward, NAGA Group said that as H1 2024 was primarily focused on completing the merger‘s legal and regulatory approvals as well as initiating operational synergies, it is optimistic about achieving targeted results by the end of 2024. The company remains fully committed to delivering on these objectives. While NAGA anticipates that macro-economic conditions may continue to pose challenges to trading activity, its is confident that the synergies from the recent merger will play a crucial role in driving performance. NAGA expects these synergies to have their full effect during the reporting year of 2025, during which time it also foresees an improvement in EBITDA margins.

NAGA Group’s complete Half-Year Report 2024 can be downloaded here.

About NAGA Group

NAGA is a German fintech company based in Hamburg and listed on the open market in the Basic Board segment of the Frankfurt Stock Exchange. The Group‘s core business is online brokerage.

In addition to traditional trading, NAGA also offers a SuperApp with the aim to merge social trading, investing in stocks, cryptocurrencies, and neo banking into one unified platform, powered by its proprietary advanced technology. The platform features a physical VISA card with fi at and automatic crypto conversion plus cashback, dynamic social feeds, and advanced autocopy functions, enabling users to replicate the strategies of successful traders. Designed for a global community, NAGA provides an inclusive and efficient financial ecosystem for personal finance and trading.

Operating in over 100 countries with 12 local offices, NAGA offers a diverse range of services for both fiat and cryptocurrencies.