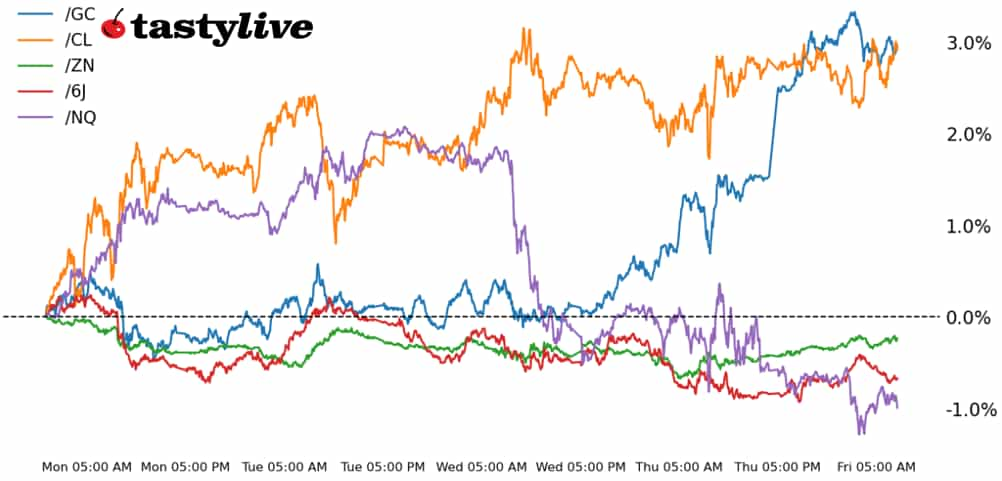

Also, 10-year T-note, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): -0.61%

- 10-year T-note futures (/ZN): +0.33%

- Gold futures (/GC): +0.89%

- Crude oil futures (/CL): -0.07%

- Japanese yen futures (/6J): +0.3%

Global financial markets are in a flight to safety today as traders continue to digest the implications of Trump’s auto tariffs. Investors are coming around to the idea that turbulence is a feature and not a bug of the current environment, with Canadian Prime Minister Mark Carney’s remarks yesterday—the old U.S.-Canadian relationship “is over”—underscoring the severity of shifting geopolitical tectonics. Data released this morning reaffirmed fear among U.S. consumers, with the savings rate rising to its highest level since June 2024 as incomes outpaced spending. While equity markets are struggling at the end of the week, bonds are finding new life and precious metals are soaring to fresh highs.

|

Symbol: Equities |

Daily Change |

|

/ESM5 |

-0.44% |

|

/NQM5 |

-0.61% |

|

/RTYM5 |

-0.31% |

|

/YMM5 |

-0.32% |

Stocks fell today as tariffs clouded the outlook for the economy. The inflation report this morning added to uncertainty and puts a question mark on how the Federal Reserv will respond if inflation rises and growth stalls. Lululemon Athletica (LULU) fell more than 13% in early trading after providing weaker-than-expected guidance in its fourth-quarter report. U.S. Steel (X) rose 3% after Nippon said it would be willing to invest as much as $7 billion in the U.S., according to Semafor.

|

Strategy: (49DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 17800 p Short 18100 p Short 21500 c Long 21800 c |

64% |

+1260 |

-4740 |

|

Short Strangle |

Short 18100 p Short 21500 c |

70% |

+5230 |

x |

|

Short Put Vertical |

Long 17800 p Short 18100 p |

82% |

+830 |

-5170 |

|

Symbol: Bonds |

Daily Change |

|

/ZTM5 |

+0.04% |

|

/ZFM5 |

+0.19% |

|

/ZNM5 |

+0.33% |

|

/ZBM5 |

+0.81% |

|

/UBM5 |

+1.12% |

Yields fell across the curve, as traders adjusted interest rate cut bets following the hotter-than-expected core reading in the inflation data. Despite today’s drop in yields, the 10-year rate remains positive on the week. 10-year T-note futures (/ZNM5) rose 0.44% in early trading. The increase in bond prices comes after several weak auctions for notes this week, with foreign demand lagging behind recent auctions.

|

Strategy (56DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 107.5 p Short 109 p Short 113.5 c Long 115 c |

66% |

+390.63 |

-1109.38 |

|

Short Strangle |

Short 109 p Short 113.5 c |

70% |

+671.88 |

x |

|

Short Put Vertical |

Long 107.5 p Short 109 p |

87% |

+203.13 |

-1296.88 |

|

Symbol: Metals |

Daily Change |

|

/GCM5 |

+0.89% |

|

/SIK5 |

+0.76% |

|

/HGK5 |

+0.55% |

Gold prices took advantage of the inflation data, which pushed yields and the dollar lower. The metal is now trading at all-time highs, and the stubborn core reading in prices will likely continue to support precious metals. Perhaps the most notable observation as we approach the end of the quarter is that gold is on track to post the best quarterly advance since 1986. This type of strength doesn’t just unravel overnight, and without a fundamental shift in the economic backdrop, gold prices are likely to move higher in the second quarter.

|

Strategy (60DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 3065 p Short 3070 p Short 3170 c Long 3175 c |

22% |

+390 |

-110 |

|

Short Strangle |

Short 3070 p Short 3170 c |

59% |

+11110 |

x |

|

Short Put Vertical |

Long 3065 p Short 3070 p |

63% |

+210 |

-290 |

|

Symbol: Energy |

Daily Change |

|

/CLK5 |

+0.07% |

|

/HOK5 |

-0.2% |

|

/NGK5 |

-0.41% |

|

/RBK5 |

+0.32% |

Crude oil prices pulled back from the $70 per barrel level, with prices (/CLK5) dropping 0.24% this morning. The commodity is on track to record a third weekly gain, as supply concerns mount on Iran and Venezuela. Reports suggest that India will trim its imports from Venezuela as well as China. The U.S. trade measures have injected uncertainty into the global crude complex. Earlier this week, the Energy Information Administration (EIA) reported a larger-than-expected pullback in U.S. inventory levels. The downside risk remains to be spare capacity from the OPEC+ group, which will likely release more supply on the market if prices remain elevated. Technically, a support level from February around 70 appears to be turning into resistance, which could cap further upside.

|

Strategy (48DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 67 p Short 67.5 p Short 71 c Long 71.5 c |

23% |

+360 |

-140 |

|

Short Strangle |

Short 67.5 p Short 71 c |

54% |

+3720 |

x |

|

Short Put Vertical |

Long 67 p |

59% |

+200 |

-300 |

|

Symbol: FX |

Daily Change |

|

/6AM5 |

-0.05% |

|

/6BM5 |

-0.1% |

|

/6CM5 |

-0.01% |

|

/6EM5 |

-0.14% |

|

/6JM5 |

+0.3% |

Japanese yen futures (/6JM5) rose after prices hit the lowest levels since mid February, as the dollar sees a broader pullback following this morning’s data. Japanese lawmakers are becoming more focal about the weakness in their currency. A weak Yen can hit consumption in the country, because it makes imports more expensive. Yield differentials are working in the yen’s favor to end the week, but the currency is on track to record a weekly loss.

|

Strategy (42DTE, ATM) |

Strikes |

POP |

Max Profit |

Max Loss |

|

Iron Condor |

Long 0.00635 p Short 0.0065 p Short 0.0069 c Long 0.00705 c |

65% |

+387.50 |

-1487.50 |

|

Short Strangle |

Short 0.0065 p Short 0.0069 c |

70% |

+637.50 |

x |

|

Short Put Vertical |

Long 0.00635 p Short 0.0065 p |

87% |

+137.50 |

-1737.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.