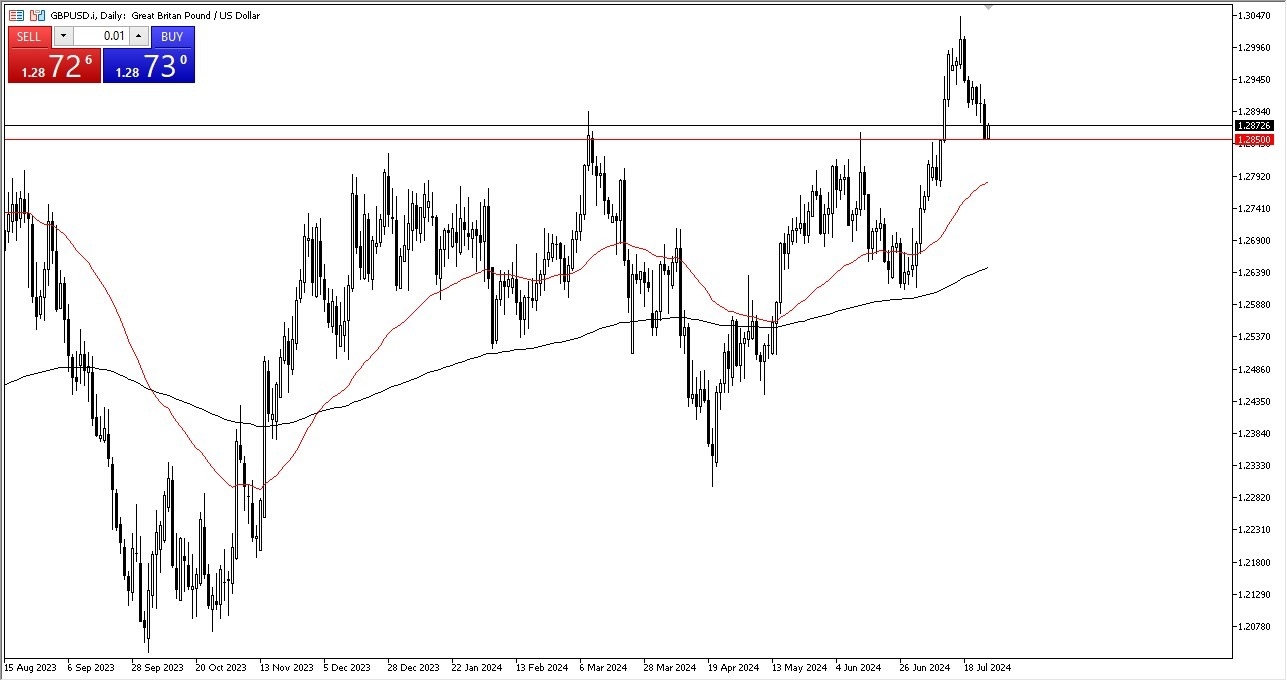

- The British pound has rallied a bit during the early hours on Friday as it looks like the 1.2850 level is going to continue to offer market memory.

- After all, this is an area that previously had been resistance and the fact that we bounced directly from that level tells me there is a lot of interest here.

- Whether or not we can take out the top of the candlestick during the Thursday session is going to be the question.

If we could break above there, then it’s likely that we could go looking to the 1.30 level. This is a market that has been extraordinarily bullish for some time. And now that we’ve had this little bit of a pullback, I do think that a lot of people are willing to jump in and try to take advantage of cheap pounds.

Where We Could Go…

From the latest swing high, we dropped down to almost the 50% Fibonacci retracement level or from the even bigger swing, we dropped down to the 23.6% Fibonacci retracement level. Perhaps traders are looking at that, but ultimately, I think what we are seeing here is that they believe the Federal Reserve is going to cut rates. And as long as that’s going to be the case, it does work against the value of the greenback in general. With this, I think taking out the Thursday candlestick is the clue that you’re looking for that the momentum has clearly returned. For what it’s worth, there has been more of a risk on attitude in the markets over the last 24 hours. So that of course helps the British pound against the greenback GBP/USD which is the world’s safety currency.

With this being said, a lot of people will be paying close attention to the Bank of England over the next week or two, as it has to make several decisions. The Federal Reserve is expected to cut rates once or twice between now and the end of the year, so that of course will be priced on the market already.

Ready to trade our GBP/USD Forex forecast? Here’s some of the best forex broker UK reviews to check out