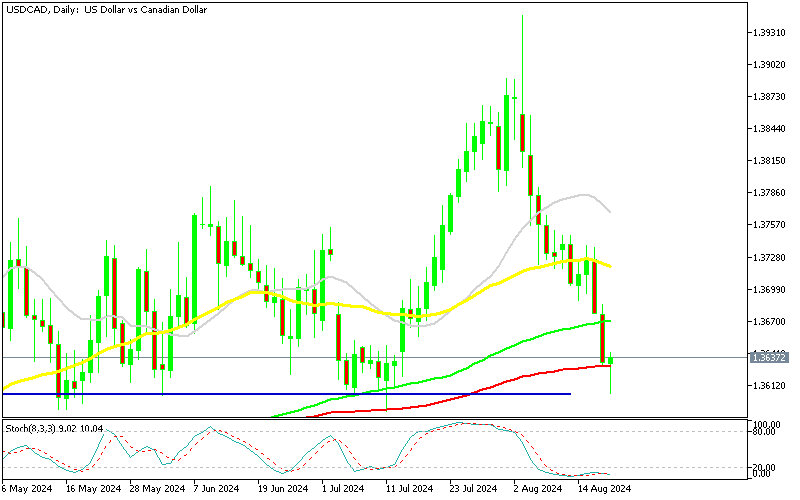

USDCAD made quite a bearish reversal in the first week of August after a surge in July, losing nearly 3.5 cents on the way down, but the fall might have ended today. After a strong surge in July, this currency pair began to decline as risk sentiment improved, erasing all previous gains. However, the price has found support at the 100-day SMA, indicating that the decline might be nearing its end, especially given the mixed fundamentals.

USD/CAD Chart Daily – The 100 SMA Holds As Support Again

The Canadian dollar is under pressure due to bearish crude oil prices, a weakening Canadian economy, and the Bank of Canada’s recent interest rate cuts, with consumer inflation (CPI) declining, as we saw in today’s CPI report. Despite a weak USD, the pair managed to rise 30 pips today, driven by soft economic news that heightened expectations for further BOC rate cuts, which shows that the CAD is the weakest currency today. The daily candlestick has formed a hammer, which points to a bullish reversal after the decline.

Canada July 2024 Inflation Report

- Canada July CPI: +2.5% YoY, as expected (Prior: +2.7%)

- CPI m/m: +0.4%, matching expectations (Prior: -0.1%)

Core Measures:

- CPI Bank of Canada Core y/y: +1.7% (Prior: +1.9%)

- CPI Bank of Canada Core m/m: +0.3% (Prior: -0.1%)

- Core CPI m/m SA: +0.1%, in line with prior

- Median CPI: +2.4% (Prior: +2.6%)

- Trimmed CPI: +2.7% (Prior: +2.9%)

- Common CPI: +2.2% (Prior: +2.3%)

Price Changes:

- Passenger vehicles: -1.4% y/y in July

- Used vehicles: -5.7% y/y in July

- Traveler accommodation: -3.7% y/y in July (but up m/m)

- Air transportation: -2.7% y/y in July (but up m/m)

- Shelter prices: +5.7% y/y in July (June: +6.2%)

- Mortgage interest cost index: +21.0% y/y in July (June: +22.3%)

- Full report

USD/CAD exchange rate stood at 1.36 but after the report revealed lower core inflation, this pair rose to 1.3635. However, the USD has since been declining against all major currencies, which means that the Cad has turned even weaker now. The year-over-year growth rate is now at its slowest in over three years. Ahead of the news, the Bank of Canada’s year-end pricing was reduced by 70 basis points, bringing it to a total of 75 basis points.

The overall drop in inflation was widespread, driven by lower costs for energy, passenger vehicles, and vacation packages. Although the month-over-month figure showed a 2.4% increase, this rise is expected to be temporary, given the recent cracks in the economy and the drop in oil prices. In Canada, high interest rates remain the primary driver of inflation, particularly due to the country’s rising property values.

USD/CAD Live Chart

USD/CAD