The US Dollar Index (DXY) spent most of the week sideways, but markets like AUDUSD and XAUUSD offered some incredible opportunities.

Watch today’s video below to see how I’m trading next week, including the latest on the DXY, EURUSD, GBPUSD, AUDUSD, and XAUUSD!

US Dollar Index (DXY) Forecast

The DXY had an uneventful week, trapped in a tight range between 104.00 support and 104.50 resistance.

The recent reclaim of 104.00 looks relatively bullish for the US dollar.

However, without a sustained break above 104.50, there isn’t much evidence of bullish intent toward the 105.00 resistance area.

There’s a chance the recent intraday price action could form an inverse head and shoulders pattern, but a sustained break above 104.50 is required to confirm this reversal pattern.

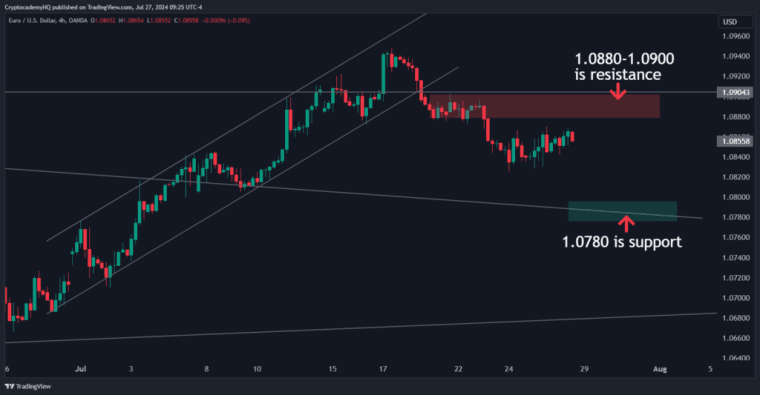

EURUSD Forecast

With the DXY mostly sideways, it’s no surprise that EURUSD had a relatively calm week.

However, there was some follow-through from the recent fakeout above 1.0925, which I’ve discussed in recent videos as a potential factor leading to euro weakness.

Currently, there’s an imbalance toward the recent lows at 1.0880, which may get filled in the coming days.

Additionally, the 2021 weekly trend line near 1.0800 could act as a magnet.

GBPUSD Forecast

GBPUSD has trended lower since testing the 1.3000 resistance confluence I mentioned earlier this month.

On Thursday, the pound closed below the March high of 1.2900, which could serve as resistance next week.

Friday’s session is bouncing from the 1.2850 highs, but I maintain a relatively bearish bias toward the 1.2750 support confluence.

AUDUSD Forecast

AUDUSD had an eventful week, dropping 170 pips since the breakdown discussed in last weekend’s forecast video.

If you saw the video, you know the Australian dollar broke its April support on July 19th, triggering an aggressive selloff that took out the May and June lows at 0.6580.

The 0.6580 area flips to resistance next week, with support near 0.6450.

However, as mentioned to VIP members last week, how AUDUSD tests 0.6580 will determine whether it’s a viable short setup.

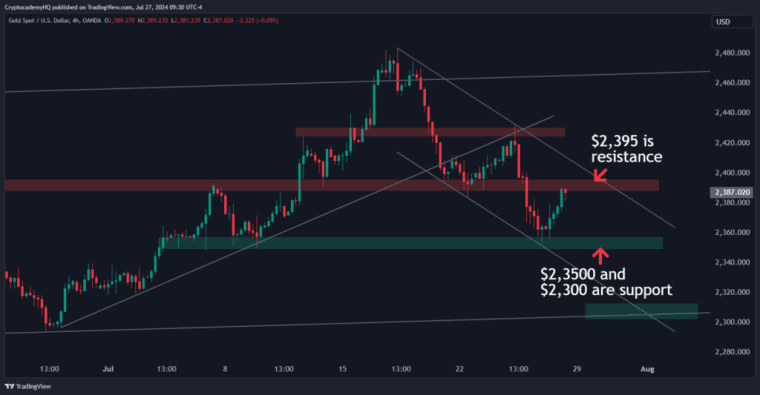

XAUUSD (Gold) Forecast

Gold offered some excellent price action last week.

I posted in the VIP group to watch for shorts around $2,425, and we saw XAUUSD test that area perfectly and then drop over 3% on Thursday.

I then told members to watch around $2,355 with a $2,390 target, which we got on Friday.

For now, I think it’s time to see if gold gives us some consolidation in this range early next week.

Ideally, we get consolidation, followed by a retest of descending channel resistance for the final leg toward $2,300.