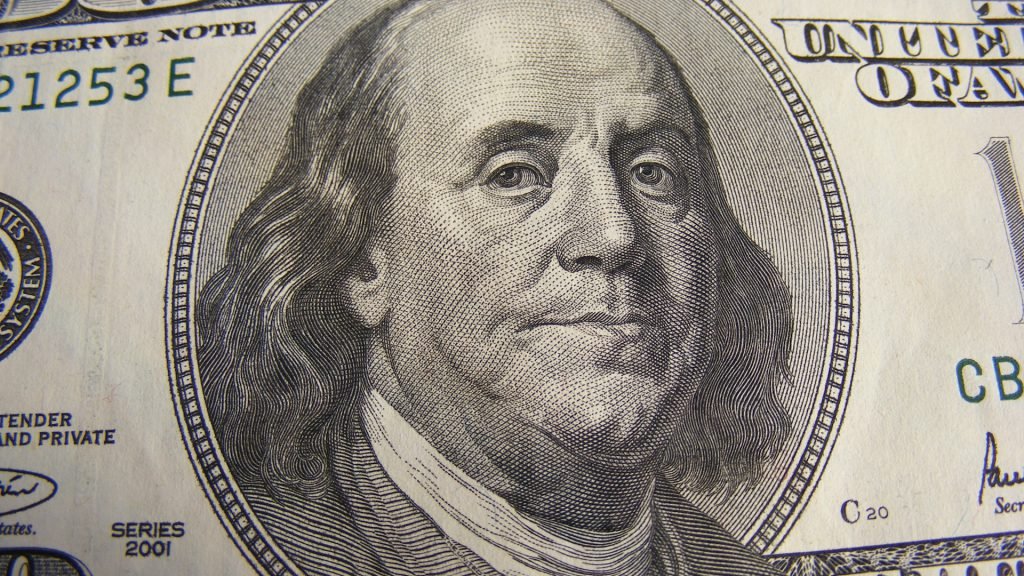

Bloomberg’s Senior Editor Chris Anstey analyzed the future of the de-dollarization initiative kick-started by the BRICS alliance this year. The bloc wants to put a full stop to the US dollar and uproot it from the world’s reserve currency status. The agenda is to put local currencies ahead for trade which could lead to the natural death of the USD.

Also Read: BRICS: U.S. Dollar Crisis Could Begin in 2025

Read here to know how many sectors in the US will be affected if BRICS ditches the dollar for trade. While the idea sounds easy on paper, the reality is painstakingly different as the currency markets are dependent on each other. The Bloomberg analyst predicted that the BRICS de-dollarization initiative will just be a “dream” that “remains a fantasy” forever.

BRICS: De-Dollarization Will Remain a Fantasy, An Unrealistic Dream: Bloomberg Analyst

The Bloomberg analyst wrote that the BRICS 2024 summit on de-dollarization showed no real danger to the US dollar’s prospects. The alliance only made a splash by showing the mock-up of a BRICS currency which was not even real. They managed to gain eyeballs and headlines but have no real underlying probabilities to launch a currency in the markets.

Also Read: BRICS: 85% Trade Settled in Local Currencies, Not US Dollar

Forget de-dollarization, the BRICS summit in October didn’t even discuss using local currencies among each other for trade. The Chinese yuan, Russian ruble, and Indian rupee were not even suggested as a means of payment with member nations. “But China for now isn’t ready to provide even its top partner Russia with sufficient yuan. It wasn’t even suggested as a means of payment at the BRICS summit this week,” wrote the Bloomberg analyst.

Also Read: Goldman Sachs Predicts the Future of BRICS Currency

Unlike the US dollar, local currencies lack liquidity and cannot stand strong against a turbulent market. The BRICS currency is yet to be launched and might take years to even be formed (if at all it is under works). CBDC currencies are extremely volatile and could cause business disruptions. Therefore, the only solution to these problems is the US dollar, wrote the Bloomberg analyst, citing that de-dollarization will fail.