Russia hosted the BRICS summit, where Vladimir Putin proposed a new financial system without the dollar. What is known about it?

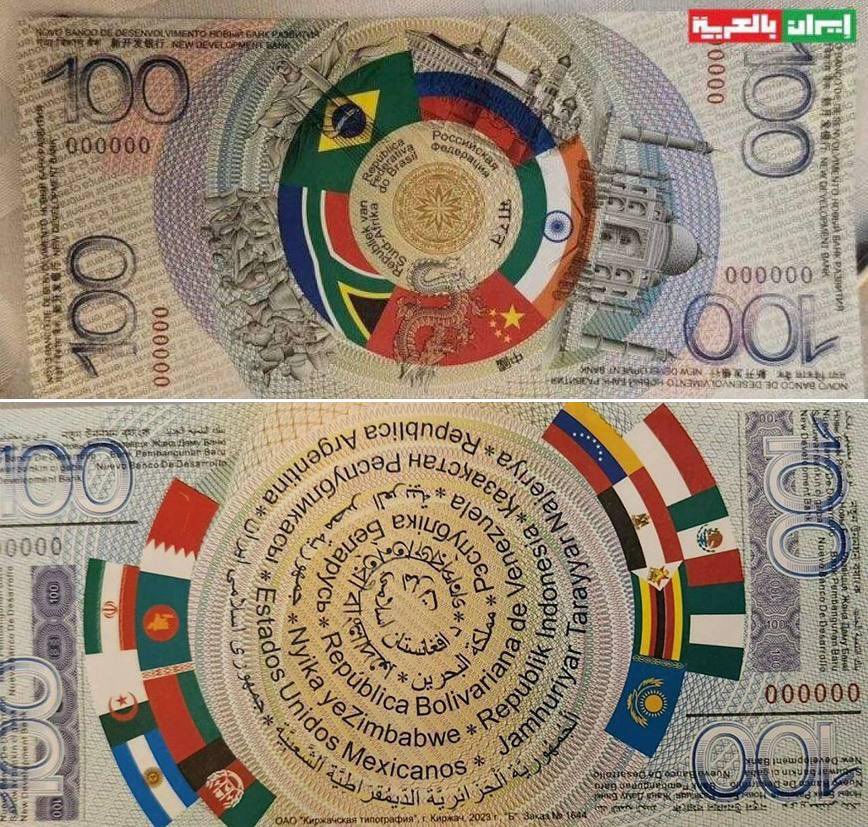

During the BRICS summit in Kazan, Russian President Vladimir Putin noted that the issue of creating a single currency is not yet relevant since it is not yet ripe.

He explained that the development of such a currency requires a high degree of integration of economies, which should be of “comparable quality and volume.” This remains a prospect for the future.

At the same time, Russia offered its BRICS partners the opportunity to use digital currencies for investment. Finance Minister Anton Siluanov clarified that this is about a new BRICS payment system, including a system for transmitting financial messages between banks and a platform for using digital financial assets.

Chairman of China Xi Jinping emphasized that the BRICS countries need to work on creating new digital platforms. The core of the reform proposed by the head of the PRC is a new system for international payments called BRICS Pay based on blockchain and CBDC.

How the new payment system might work

Among the main initiatives, the countries are considering the possibility of using digital money backed by fiat currencies. This would allow central banks, rather than correspondent banks with access to the dollar clearing system in America, to participate in cross-border transactions.

Thus, no country could cut off another from the financial system. Commercial banks would make payments through their regulators and would not need to maintain bilateral relations with foreign organizations.

In October, the Ministry of Finance and the Central Bank of Russia presented a plan to develop a similar system. As the Economist magazine notes, this project draws inspiration from the experimental bridge payment platform the Bank for International Settlements (BIS) created in collaboration with the central banks of China, Hong Kong, Thailand, and the United Arab Emirates.

The project participants report that they have significantly reduced the time spent conducting transactions from several days to several seconds and reduced transaction costs to almost zero.

A change of course?

The Russian President’s proposal took into account the new realities. Over the several years that the creation of a single BRICS currency was being discussed, digital technologies have changed. The digital ruble is already being tested for consumer payments in Russia. It will soon be used in federal budget payments.

According to Russian media, the transition to digital assets will reduce transaction costs and grow bank income by $81 billion per year. The project itself fits into the logic of the advantages of digital government promoted by Russia:

“The implementation of the project, in addition to modernizing the financial sectors of dozens of countries, will require building interaction between payment systems, answering questions about the rates of digital currencies, and creating an analog of the IMF from.”

How Russia bypasses sanctions through cryptocurrencies

If trade restrictions previously led to critical complications in countries’ financial lives, the situation became more variable with the invention of the Internet and cashless payments. With the development of blockchain and cryptocurrencies, there are even more opportunities to bypass bans.

The Tether (USDT) stablecoin, tied to the american dollar exchange rate, has effectively created a financial system beyond Washington’s control and helps countries bypass U.S. sanctions. In this case, a decentralized financial system that is not controlled by the United States and copies the functions of the dollar.

According to Chainalуsis, Russia and several other sanctioned countries use several methods to overcome international financial sanctions.

“Putin has called on Russia ‘not to miss the moment’ in regulating cryptocurrencies, emphasizing their growing role in global payments and potential to reduce reliance on the U.S. dollar.”

Chainalуsis report

The report emphasizes that the country is actively developing infrastructure for using cryptocurrencies in international trade to bypass Western restrictions. Russia’s Central Bank is leading this process and overseeing the testing of transactions with digital coins.

In addition, according to experts, Russian centralized crypto exchanges may soon process cross-border payments. Local authorities may also use services such as Garantex, either officially or unofficially.

The West is trying to stop Russia

Amid the growth of cross-border payments in stablecoins, the U.S. Treasury Department has called on Congress to give it more powers to control cryptocurrency exchanges registered abroad and to cut off sanctions evasion, including those issued by Russia.

Ahead of the Senate hearing on countering illegal financial transactions, U.S. Deputy Secretary of the Treasury Adewale Adeyemo said Russia is increasingly turning to alternative payment mechanisms, including stablecoins, to circumvent sanctions.

According to Bloomberg, the U.S. and the U.K., among others, have been checking crypto transactions worth more than $20 billion. According to sources, the transactions were conducted through the Russian crypto exchange Garantex using USDT.